SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Exchange Act of 1934 (Amendment No. )

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

![[MISSING IMAGE: lg_gatesheader-k.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-055640/lg_gatesheader-k.jpg)

27, 2021

You

meeting and provide detail on the virtual meeting format, including how to register.

www.proxyvote.com.

While most Regardless of our shareholders are unlikelywhether you plan to be able to attendparticipate in the AGM in person, it is important that your shares be represented and voted at the Meeting. Wemeeting, we encourage you to vote your shares as promptly as possible.

Thank you for your continued interest in our company.

![[MISSING IMAGE: sg_ivojurek-k.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-055640/sg_ivojurek-k.jpg)

Chief Executive Officer

i i ii ii 1 1 5 5 8 9 14 17 24 40 49 50 40 41 52 42 42 53 43 54 44 55 44 56 Proposals 9, 10, 11 and 12: Creation of Distributable Reserves, Bonus Issue and Capital Reduction444646 48 57 51 60 53 62 54 55 63 55 64 56 65 A-1 A-1 B-1

|

|

|

|

|

|

1. To elect the nine director nominees identified in this Proxy Statement. 2. To conduct an advisory vote to approve named executive officer compensation. 3. To conduct an advisory vote on the Company’s directors’ remuneration report (the “Directors’ Remuneration Report”) contained in Appendix A of this Proxy Statement in accordance with the requirements of the United Kingdom (the “U.K.”) Companies Act 2006 (the “Companies Act”). 4. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending January 1, 2022. 5. To re-appoint Deloitte LLP as the Company’s U.K. statutory auditor under the Companies Act (to hold office until the conclusion of the next annual general meeting at which accounts are laid before the Company’s shareholders). 6. To authorize the Audit Committee of the Board of Directors of the Company (the “Board” or “Board of Directors”) to determine the remuneration of Deloitte LLP in its capacity as the Company’s U.K. statutory auditor. 7. To transact such other business as may properly come before the AGM or any adjournment thereof. |

|

|

|

|

|

|

|

ii

|

The above proposals are more fully described in the Proxy Statement following this Notice, which shall be deemed to form a part of this Notice.

Our 2018 Annual Report, which includes our The Company’s Annual Report on Form10-K for the fiscal year ended December 29, 2018,January 2, 2021 (the “2020 Annual Report”) accompanies the Proxy Statement following this Notice.

These documents may also be accessed free of charge at www.proxyvote.com

23, 2021.

attend.

Jamey Seely

![[MISSING IMAGE: sg_ivojurek-k.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-055640/sg_ivojurek-k.jpg)

Chief Executive

Corporate Secretary

Officer

FOR THE

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 23, 2019:

JUNE 17, 2021:

iii

ANNUAL GENERAL MEETING OF SHAREHOLDERS

May 23, 2019

27, 2021.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

The resolutions proposed in proposals 11 through 13 will be proposed as special resolutions, which means that, assuming a quorum is present, the resolutions will be approved if shareholders representing at least 75% of the votes cast in favor thereof.

What are the Board’s recommendations?

Our

vote. Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted

FOR proposals 1Proposals 6, 74, 5 and 86 are considered routine matters, and a broker will be permitted to exercise its discretion to vote uninstructed shares on these proposals. This means that, if you do not provide voting instructions on proposal 6, 74, 5 or 8,6, your broker may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of Deloitte & Touche LLP as ourthe Company’s independent registered public accounting firm for the fiscal year ending December 28, 2019,January 1, 2022, there-appointment of Deloitte LLP as the Company’s U.K. statutory auditor for the year ending December 28, 2019January 1, 2022 and to authorize the Audit Committee to determine the remuneration of Deloitte LLP, but cannot vote your shares on any other matters being considered at the AGM.

•

•20182020 Annual Report, the proxy card and the UK annual report and accounts for the year ended December 29, 2018, along withJanuary 2, 2021, and the cost of posting the proxy materials on a website, are to be borne by us.website. In addition to the use of mail, ourthe Company’s directors, officers and employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries. Wesalaries for this work. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. WeThe Company may reimburse these persons for their expenses in so doing.

Our

Two of the current directors, Ms. Kahr and Mr. Simpkins, are designees of the Sponsor.

| Name | | ||||||

| | Age | | | Position | | |

| | | | | Director, | ||

| |||||||

Ivo Jurek | | | | | Director, Chief Executive Officer | | |

James W. Ireland, III | | | 66 | | | Director | |

| Julia C. Kahr | | | | | Director | | |

Terry Klebe | | | | | Director | | |

Stephanie K. Mains | | | | | Director | | |

| | | 65 | | | Director | |

| | | | | Director | | |

| Molly P. Zhang | | | 59 | | | Director | |

David L. Calhoun

in significant general management positions in International Rectifier Corporation and TRW Inc.

Ivo Jurek has served as a director of Gates Industrial Corporation plc since its formation in September 2017 and has served as our Chief Executive Officer and Director since May 2015. Mr. Jurek oversees and manages all of Gates’ departments and lines of products and services globally. As CEO, Mr. Jurek has led Gates to expand product lines in fluid power and power transmission, and strategically grow market share through acquisitions and joint ventures, while driving improved financial performance through increased plants efficiency. Mr. Jurek has a deep understanding of new technology development, manufacturing, distribution and international business markets. Prior to joining Gates, Mr. Jurek served as President of Eaton Electrical, Asia Pacific from November 2012. During that time, Mr. Jurek had management oversight of Eaton Electrical’s Asia Pacific portfolio which included optimizing manufacturing plants, identifying new markets, and assisting with the overall performance of the company. Prior to that, Mr. Jurek served as Group President for Cooper Power Systems—Cooper Bussmann, with complete oversight of all business activities there and in significant general management positions in International Rectifier Corporation’s and TRW Inc.

Terry Klebehas served as a director of Gates Industrial Corporation plc since its formation in SeptemberDecember 2017 and has served as a director of Gates entities since 2016. Mr. Klebe was previously Senior Vice President and Chief Financial Officer of Cooper Industries plc, a multinational industrial manufacturing company with 2010 revenues of $5.1 billion, from 2002 until his retirement in February 2010. Following his retirement as Chief Financial Officer, Mr. Klebe continued to serveremained on the executive management team as vice chairmanVice Chairman at Cooper through his retirement inIndustries plc from February 2010 until April 2011. Mr. Klebe also served on the Boardboard of Directorsdirectors of Fairchild Semiconductors and as a head of the company’s Audit Committee until its sale.

sale in September 2016.

John Plantdirectors for Diamondback Energy, Inc., Stryten Manufacturing, LLC, and LCI Industries.

Neil P. SimpkinsTexas Law School Foundation.

Germany.

particular, the members of our Board of Directors considered the following important characteristics, among others:

•

Mr. Jurek’s extensive business and industry experience as well as his experience leading Gates since May 2015.

•

Mrs.

Mr. Simpkins’ significant financial and

Our

standards.

the policy of the Board of Directors that directors are invited to attend the AGM, although such attendance is not mandatory.

In 2020, one director, Ivo Jurek, attended the AGM.

The Board’s Role in Risk Oversight

Our Board exercises direct oversight of strategic risks to the Company. The Audit Committee reviews guidelines and policies governing the process by which management assesses and manages the Company’s exposure to risk, including the Company’s major financial risk exposures and the steps management takes to monitor and control such exposures. The Compensation Committee oversees risks relating to the Company’s compensation policies and practices. Each committee charged with risk oversight reports to the Board on those matters.

Additionally, with respect to cybersecurity risk oversight, our Board and our Audit Committee receive updates from our information technology team to assess the primary cybersecurity risks facing the Company and the measures the Company is taking to mitigate such risks. In addition to such updates, our Board and our Audit Committee receive updates from management as to changes to the Company’s cybersecurity risk profile or significant newly identified risks.

Executive Sessions

To ensure free and open discussion and communication among thenon-management directors of the Board, thenon-management directors meet in executive session at most Board meetings with no members of management present. Our Chairman presides over executive sessions.

Board Committees

Our

Our

•

Act of 1933, as amended from time to time (the “

Securities Act”).Compensation Committee

Our

•

2020.

Our

•

The Board’s Role in Risk Oversight

We maintain

Our

The Company and certain of its affiliates are party to certain transactions with Blackstone described in the “Related-Person Transactions Policy and Procedures” section of this Proxy Statement.

| Name | | ||||||

| | Age | | | Position | | |

| | | | | | ||

| | | | ||||

| |||||||

| |||||||

| | Executive Vice President | | ||||

| Grant Gawronski | | | 58 | | | Executive Vice President and Chief Commercial Officer | |

| Walter Lifsey | | | 62 | | | Executive Vice President and Chief Operating Officer | |

| L. Brooks Mallard | | | 54 | | | Executive Vice President and Chief Financial Officer | |

| Thomas Pitstick | | | 49 | | | Chief Marketing Officer and Senior Vice President of Strategic Planning | |

Roger C. Gaston

Mr. Gaston worked as Senior Vice President-President — Human Resources for Avaya, a multibillion dollarmultibillion-dollar enterprise telecommunications and solutions company sincebeginning in 2006. At Avaya, Mr. Gaston oversaw all aspects of human resource management and industrial relations policies, practices and operations. Before Avaya, Mr. Gaston was a Corporate Vice President-President — Human Resources for Storage Technology Corp. from 2000 to 2005. Prior to Storage Technology Mr. Gaston served as the Senior Vice President, Human Resources for Toys R Us, Inc. from 1996-2000. A Chapter 11 petition for bankruptcy protection was filed by Avaya in January of 2017.

David Naemura

Jamey Seelyhas held senior financial leadership roles with TRW Automotive, Cooper Industries plc, Thomas & Betts, and Briggs & Stratton during his career.

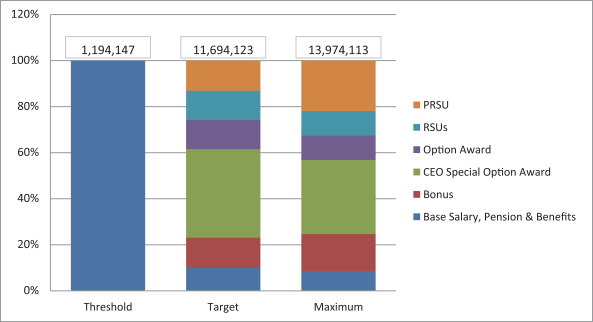

Executive Summary

This Compensation Discussion & Analysis (“

| Name | | | 2020 Position | |

| |

| | |

Ivo Jurek | | | Chief Executive Officer | |

| | | | |

| L. Brooks Mallard | | | Chief Financial Officer | |

David Wisniewski | | | Chief Financial Officer (interim) and Chief Accounting Officer | |

| David Naemura | | | Chief Financial Officer (former) | |

| Next Three Most Highly Compensated Executive Officers | | | | |

| Roger Gaston | | | Chief Human Resources Officer | |

| Grant Gawronski | | | Chief Commercial Officer | |

Walter Lifsey | | | Chief Operating Officer | |

|

Our philosophy is

Corporate the shareholder advisory vote on 2019 executive compensation when making decisions relating to the compensation of the Named Executive Officers and the Company’s executive compensation program and policies. The shareholders voted at the 2020 AGM, in a non-binding, advisory vote, on the 2019 compensation paid to our Named Executive Officers. Approximately 99% of the votes were cast in favor of the Company’s 2019 compensation decisions. Based on this level of support, the Compensation Committee decided that the “say-on-pay” vote result did not necessitate any substantive changes to the compensation program.

| | | | Compensation Practice | |

| |

| ||

— The majority of the

|

— No incentive funding when Company performance on a metric does not meet threshold requirements for such metric under

— 50% of the Chief Executive Officer’s equity-based compensation is performance based to motivate enhancement of long-term shareholder value. — Compensation Committee review of executive tally sheets reflecting all compensation components to ensure that compensation decisions are in line with the Company’s pay-for-performance philosophy. | | ||

| Excellence on the Board | | | — Annual election of directors by majority vote. — Separation of Chair and Chief Executive Officer roles. — All members of Audit Committee are financial experts. | |

| Robust Stock Ownership Guidelines | | | Stock ownership guidelines of 6x base salary for the Chief Executive Officer; 3x base salary for other executive officers and certain senior vice presidents; 4x cash retainer for directors. | |

| Double Trigger Change in Control | | | Executive Change in Control Plan and, beginning in 2020, equity grants require both a change in control and a qualifying termination for accelerated vesting. | |

| Strict Trading Policy; Anti-Hedging and Pledging Policies | | | Enforcement of a strict trading policy; no hedging or pledging of Company stock by executives or directors. | |

| Clawback Policy | | | Recovery of incentive cash and equity compensation in certain circumstances if it was paid based on inaccurate financial statements. | |

| | | | Compensation Practice | |

| Tax Gross-Ups | | | No excise tax or income tax gross-ups (except in the event of relocation). | |

| Employment Contracts | | | None of the current Named Executive Officers have an employment contract. | |

such as considering the responsibilities, performance, contributions and experience of each Named Executive Officer and their compensation in relation to other employees and other equivalent roles.

In addition, the Board takes into account our Chief Executive Officer’s judgment and knowledge of our industry when considering recommendations for executive officer compensation. Our Chief Executive Officer

The Board annually reviews our Chief Executive Officer’s performance, base salary, annual incentive target opportunity and outstanding long-term incentive awards and approves any changes to the Chief Executive Officer’s overall compensation package in light of such review. OurThe Chief Executive Officer does not participate in deliberations regarding his own compensation.

Timing

Compensation decisions with respect to prior year performance, as well as annual equity awards and target performance levels under our incentive plans for the current year are typically made at this February meeting. Any equity awards recommended by the Compensation Committee at this meeting are reviewed by the Board and, if approved, are dated on the date of the Board meeting held later that day or the following day. The exception is executive compensation, including equity grants, to executives who are promoted or hired from outside the Company during the year. These executives may receive compensation changes or equity grants effective or dated, as applicable, as of the date of their promotion, hiring date, or other Board approvalapproved date.

Role of the Independent Compensation Consultant. We have retained an independent compensation consultant, Aon (the “Consultant”), to support the oversight and management of our executive compensation program.

In fiscal 2018, the Consultant performed a variety of work, including but not limited to: attending Compensation Committee meetings and preparing materials and analysis for any program changes; advising the Compensation Committee on executive compensation trends and regulatory developments; providing a comprehensive risk assessment of our compensation programs; reviewing our peer group; providing a total compensation study to assist in comparing our compensation program against peer companies’ programs; providing advice to the Compensation Committee on governance best practices, as well as any other areas of concern or risk; reviewing and commenting on proxy statement disclosure items, including preparation of this CD&A; advising the Compensation Committee on executive and directors’ pay recommendations; and providing advice and guidance on new performance-based restricted stock unit documentation.

The Compensation Committee has assessed the independence of the Consultant as required by the NYSE rules. The Compensation Committee reviewed its relationship with the Consultant and considered all relevant factors, including those set forth in Rule

Peer Group. Additionally, in 2017, the Consultant performed a competitive pay study to assist the Compensation Committee in its review and evaluation of executive and director compensation. The Consultant

developed, and the Compensation Committee approved, a peer group of fifteen companies based on the following criteria:

publicly-traded companies within similar GICS code classifications;

peer companies used by the potential peer companies within the similar GICS codes;

management and Board recommendations;

companies with annual revenues of approximately 0.4x to 3x Gates’ annual revenues; and

companies with enterprise values of approximately 0.2x to 5x Gates’ expected total enterprise value.

The peer group used to assist with 2018 compensation decisions consisted of the following companies:

Peer Group

What We Pay and Why: Elements of Compensation

Our

![[MISSING IMAGE: tm212567d1-pc_ceoneo4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-055640/tm212567d1-pc_ceoneo4c.jpg)

The Consultant assists the Compensation Committee with this process by providing market and peer group data and making recommendations.

AnnualFiscal 2020.

Payouts

| Name | | | Base Salary ($) | | | Target Annual Plan Opportunity (% of Base Salary) | | | Target Annual Plan Opportunity ($) | | |||||||||

| I. Jurek | | | | $ | 1,030,000 | | | | | | 150% | | | | | $ | 1,545,000 | | |

| B. Mallard | | | | $ | 550,000 | | | | | | 85.25%* | | | | | $ | 468,852 | | |

| R. Gaston | | | | $ | 420,000 | | | | | | 100% | | | | | $ | 420,000 | | |

| G. Gawronski | | | | $ | 667,575 | | | | | | 100% | | | | | $ | 667,575 | | |

| W. Lifsey | | | | $ | 669,231 | | | | | | 100% | | | | | $ | 669,231 | | |

| D. Wisniewski | | | | $ | 397,838 | | | | | | 50% | | | | | $ | 198,919 | | |

and the Named Executive Officer’s performance during the fiscal year against his or her individual performance goals (the “Individual Performance Factor”).

Performance Measure | |

| Description | |

| Adjusted EBITDA (50%) | | | Adjusted EBITDA under the Annual Plan is defined in substantially the same manner as described in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of | |

| Report. | | |||

| Free Cash Flow (30%) | | | Calculated as Adjusted EBITDA (as defined for purposes of the Annual Plan as described immediately above), less capital expenditures, plus or minus the change in | |

| capital versus prior year. | | |||

| Revenue (20%) | | | Revenue under the Annual Plan is defined as consolidated revenue as reflected in | |

no•

If achievement with respect to any

number. The following table outlines the calculation of the funding attainment based on thepre-established scale.

Measure | Weighting | Threshold (50% Funding for 95% of Target) | Target (100% Funding) | Maximum (150% Funding for 105% of Target) | 2018 Attainment ($) | 2018 Attainment (%) | 2018 Recommendation (%) | |||||||||||||||||||||

| (Dollars in Millions) | ||||||||||||||||||||||||||||

Adjusted EBITDA | 50 | % | $ | 708.8 | $ | 746.1 | $ | 783.4 | $ | 751.4 | 107 | % | 107 | % | ||||||||||||||

Free Cash Flow | 30 | % | $ | 529.0 | $ | 556.8 | $ | 584.6 | $ | 553.5 | (1) | 94 | % | 75 | % | |||||||||||||

Revenue | 20 | % | $ | 3,148.8 | $ | 3,316.8 | $ | 3,446.4 | $ | 3,331.9 | 106 | % | 106 | % | ||||||||||||||

Total | 103 | % | 97 | % | ||||||||||||||||||||||||

|

Notwithstanding the establishment of the performance components and the formula for determining the funding levels as described above, the Compensation Committee hasmay adjust the ability to exercise positive or negative discretion and award a greater or lesseraggregate amount available to fund the Annual Plan than the amount determined by the above formula if, in the exercise of its business judgment, the Compensation Committee determines that a greaterbut does not expect to do so absent unanticipated or lesser amount is warranted under theexceptional circumstances. For 2018, based on management’s recommendation, the Compensation Committee used its discretion to reduce the attainment percentage for Free Cash Flow from 94% to 75%, which resulted in the total attainment percentage being reduced from 103% to 97%.

| | | | | | | | | | Threshold (50% Funding for 95% of Target) | | | Target (100% Funding) | | | Maximum (150% Funding 105% of Target) | | | 2020 Attainment | | | |||||||||||||||||||||||

| Measure | | | Weighting | | | (Dollars in Millions) | | | $ | | | % | | | Funding | | |||||||||||||||||||||||||||

| Adjusted EBITDA | | | | | 50% | | | | | $ | 604.2 | | | | | $ | 636.0 | | | | | $ | 667.8 | | | | | $ | 506.6 | | | | | | 80 | | | | | $ | 0 | | |

| Free Cash Flow | | | | | 30% | | | | | $ | 503.5 | | | | | $ | 530.0 | | | | | $ | 556.5 | | | | | $ | 446.9 | | | | | | 84 | | | | | $ | 0 | | |

| Revenue* | | | | | 20% | | | | | $ | 3,029.4 | | | | | $ | 3,120.3 | | | | | $ | 3,200.0 | | | | | $ | 2,793.0 | | | | | | 90 | | | | | $ | 0 | | |

associated EBITDA levels.

Operational Excellence: Improvements in operational efficiency/productivity.

Building Organizational Capacity: Increasing talent pipeline within the organization; attracting and developing talent and growing organizational capacity.

Financial Goals: Achieving our annual financial plan.

Actual2020, actual amounts paid under the Annual Plan werewould have been calculated by multiplying each Named Executive Officer’s base salary in effect on December 31, 20182020 by (i) his or her Annual Plan target bonus opportunity (which is reflected as a percentage of base salary), (ii) the final Gates Financial Performance Factor, and (iii) the Individual

Performance Factor. There is no maximumHowever, since the Compensation Committee did not fund the Annual Plan in 2020, the Individual Performance Factor did not impact payouts.

| Name | | | 2020 Special Award | | |||

| I. Jurek | | | | $ | 1,545,000 | | |

| B. Mallard | | | | $ | 468,852 | | |

| R. Gaston | | | | $ | 399,000 | | |

| G. Gawronski | | | | $ | 634,196 | | |

| W. Lifsey | | | | $ | 669,231 | | |

| D. Wisniewski | | | | $ | 188,973 | | |

Name | Base Salary ($) | Target Bonus (% of Base Salary) | Target Bonus Opportunity ($) | Combined Performance Factor (%)* | Actual Payout ($) | |||||||||||||||

I. Jurek | $ | 945,000 | 150 | % | $ | 1,417,500 | 98 | % | $ | 1,389,150 | ||||||||||

D. Naemura | $ | 610,000 | 115 | % | $ | 701,500 | 98 | % | $ | 687,470 | ||||||||||

G. Gawronski(1) | $ | 600,000 | 75.85 | % | $ | 455,096 | 100 | % | $ | 455,096 | ||||||||||

W. Lifsey | $ | 610,000 | 100 | % | $ | 610,000 | 93 | % | $ | 567,300 | ||||||||||

J. Seely | $ | 425,000 | 70 | % | $ | 297,500 | 95 | % | $ | 282,625 | ||||||||||

| | Description | | |

| Adjusted ROIC (50%) | | | 50% of PRSU value is calculated as (Adjusted EBITDA-depreciation and amortization) x (1 — 25% tax rate)) divided by (total assets — non-restricted cash — accounts payable — goodwill and other intangible assets that arose from the acquisition of Gates by Blackstone in 2014). | |

| | | | The | |

| | Description | | |

| | | | Results of Operations — Non-GAAP Measures” of the 2020 Annual Report, (ii) the depreciation and amortization deduction excludes the amortization of intangible assets arising from | |

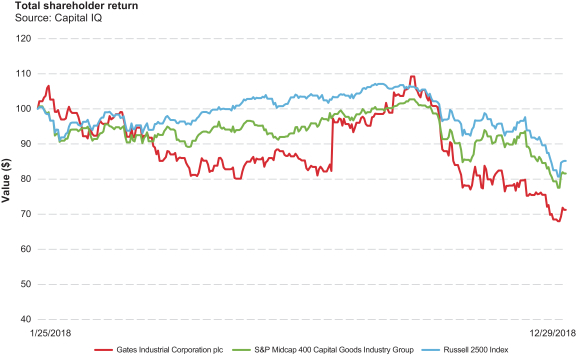

| Relative TSR (50%) | | | 50% of PRSU value is based on the | |

and Discretionary Bonuses. From time to time, wethe Company may awardsign-on and discretionary bonuses.Sign-on bonuses are used only when necessary to attract highly skilled officers to the Company. Generally, they are used to incentivize candidates to leave their current employers or may be used to offset the loss of unvested compensation they may forfeit as a result of leaving their current employers. Nosign-on or discretionary bonuses wereDuring 2020, the Company awarded a sign-on bonus of $100,000 to anyMr. Mallard designed to replace certain compensation forfeited from his previous employer when he joined the Company. Had Mr. Mallard voluntarily left the Company within one year of his start date, he would have been required to repay this sign-on bonus.2018.Long-Term Incentive. We believe that our Named Executive Officers’ long-term compensation should be directly linked to the value we deliver to stockholders. Equity awards to our Named Executive Officers are designed to provide long-term incentive opportunities over a period of several years.Historically, grants have not been made on an annual basis, and instead were made upon an executive’s commencement of employment with us, when an executive receives a promotion into a more senior-level position or to reward performance. In connection with the IPO, we adopted the Gates Industrial Corporation plc 2018 Omnibus Incentive Plan (the “2018 Omnibus Incentive Plan”), a market-based long-term incentive program which allows for awards of a mix of performance shares, stock options and restricted shares. The 2018 Omnibus Incentive Plan is informed by the peer group and broader public company practice and is consistent with our compensation objective of providing a long-term equity incentive opportunity that aligns compensation with the creation of stockholder value and achievement of business goals.2018 Grants. The Compensation Committee determined that the size, structure and value of theplace.pre-IPO grants were sufficient incentive for 2018 and therefore no additional equity grants were made in 2018, except for one time grants under the 2018 Omnibus Incentive Plan to Mr. Gawronski and Ms. Seely described below.During 2018, we made a specialone-time grant of stock options under the 2018 Omnibus Incentive Plan to each of Mr. Gawronski and Ms. Seely. Ms. Seely’s award consisted of 80,000 stock options which were granted to reward performance and in recognition of her contributions toward the completion of the IPO. Mr. Gawronski received a grant of 220,000 stock options to better align his compensation with market practices. The grant date fair values of these awards, calculated in accordance with Accounting Standards Codification Topic 718 (“Topic 718”), are reported in the Summary Compensation Table below. The stock options vest ratably on each of the first four anniversaries of the grant date, subject to the executive’s continued employment. For more information regarding the stock options, including the vesting criteria, see the section entitled “Narrative Disclosure Relating to the Summary Compensation Table and the Grants of Plan-Based Awards Table” below.

2014 Incentive Plan andCo-Invest Shares. Ourpre-IPO long-term incentive program consisted of awards under the 2014 Omaha Topco Ltd. Stock Incentive Plan, which was assumed by Gates Industrial Corporation plc and renamed the Gates Industrial Corporation plc Stock Incentive Plan in connection with thepre-IPO reorganization (the “2014 Incentive Plan”), permitting our Named Executive Officers to obtain shares in Omaha Topco. In connection with the assumption by Gates of the awards under the 2014 Omaha Topco Ltd. Stock Incentive Plan, Omaha Topco options were converted into Gates options and the exercise prices were adjusted to ensure that the options received were of equivalent economic value to the legacy Omaha Topco options. Additionally, Omaha Topco restricted stock units were converted into Gates restricted stock units.

The stock options granted under our 2014 Incentive Plan have four equally-weighted tiers. Tier I is subject to a five-year pro rata vesting schedule, and the remaining tiers are subject to vesting upon Blackstone’s achievement of specified internal rates of return or multiple of investment targets. Vesting of Tier I may accelerate upon specified events, and, for grants awarded prior to May 2017, vesting of Tiers II – IV may continue past separation of service upon specified events. For more information regarding the stock options, including the vesting criteria, see the section entitled “Narrative Disclosure Relating to the Summary Compensation Table and the Grants of Plan-Based Awards Table” below. Going forward, equity incentive awards will be made pursuant to the 2018 Omnibus Incentive Plan.

Prior to our IPO, certain of our Named Executive Officers and other eligible employees were provided with the opportunity to invest in Omaha Topco’s common stock. We considered this investment opportunity an important part of our equity program at the time because it encouraged stock ownership and aligned the investing Named Executive Officers’ financial interests with those of Omaha Topco’s stockholders. In connection with the IPO and the assumption by Gates of the awards under the 2014 Omaha Topco Ltd. Stock Incentive Plan, Omaha Topco shares were converted into Gates ordinary shares. Messrs. Jurek and Naemura participated in the program and invested 149,118 and 27,743 shares, respectively.

2019 Long-Term Incentive. In February 2019, our Compensation Committee approved the first annual long-term incentive grant (the “2019LTI”) under the 2018 Omnibus Incentive Plan to incentivize long-term business performance as well as to promote retention. The 2019 LTI is comprised of 33% time-based vesting restricted stock units (“RSUs”), 33% time-based vesting stock options and 34% performance based RSUs (“PRSUs”). Each of the RSUs and options will vest in equal annual installments on the first three anniversaries of the grant date, subject to the executive’s continued employment through the vesting date.

The awards under the 2019 LTI were granted on February 22, 2019. The target total grant date fair values for each of Messrs. Jurek’s, Naemura’s, Gawronski’s and Lifsey’s and Ms. Seely’s awards were $4,500,000, $1,382,260, $1,548,000, $1,551,840 and $658,750, respectively. The post-termination vesting and the exercise rights of the options under the 2019 LTI are substantially the same as the rights that apply to the options granted Mr. Gawronski and Ms. Seely in 2018 and described under the heading “Narrative Disclosure Relating to the Summary Compensation Table and Grants of Plan-Based Awards—Equity-Based Awards—2018 Grants”. In addition, Mr. Jurek was awarded aone-time special grant of time-based stock options with a grant date fair value of $4,500,000. These options are premium priced options which have an exercise price of $19.00 per share and vest in equal installments on the third, fourth and fifth anniversary of the grant date.

With respect to the RSUs, in the event of a termination for any reason other than death or disability prior to the vesting of the RSUs, all unvested shares of RSUs shall be forfeited. The RSUs will fully vest in the event of a termination due to death or disability and immediately prior to a change in control.

The PRSUs provide that 50% of the award will generally vest if the Company achieves a certain level of average annual Adjusted Return on Invested Capital (“Adjusted ROIC”) and the remaining 50% of the PRSUs will generally vest if the Company achieves certain Relative Total Shareholder Return (“Relative TSR”) goals, in each case, measured over a three year performance period. The total number of PRSUs that vest at the end of the performance period will range from 0% to 200% as determined by measuring actual performance over the

performance period for Adjusted ROIC and Relative TSR against the performance goals based on apre-established scale.

Payouts for achievement between the performance levels will be determined based on a straight line interpolation of the applicable payout range. The PRSU awards will vest at the end of the three-year performance period, subject to the Named Executive Officer’s continued employment through the end of the applicable performance period, and are paid out after the certification of the performance results by the Compensation Committee.

If the executive’s employment terminates for any reason other than as described below, all unvested PRSUs will be forfeited. Upon death or disability during the performance period, PRSUs representing apro-rata portion of the number of PRSUs that would have vested based on the Company’s actual performance for the entire performance period will be eligible to vest on apro-rata basis based on days employed during the performance period. Upon a change in control during the performance period, the PRSUs will vest based on the Company’s Relative TSR performance as measured through the date of the change in control and Adjusted ROIC as measured through the most recently completed fiscal quarter relative to the performance criteria determined by the Compensation Committee. Additionally, a target number of PRSUs will vest if a change in control occurs within the first six months of the performance period.

Other Aspects of Our Compensation Programs

Retirement Benefits. We offer The Company offers the following retirement benefits to eligible U.S.-based employees, including ourthe Named Executive Officers, as specified below. Additional details about the Gates Corporation Supplemental Retirement Plan (the “Supplemental Retirement Plan”), as it applies to ourthe Named Executive Officers, is included in the “2018“2020 Nonqualified Deferred Compensation” section of this Proxy Statement.

| Plan | | |||

| Description |

| ||

| Gates MatchMaker 401(k) Plan | | | A qualified defined contribution retirement benefit available to eligible U.S. employees (as defined in the plan document) that is intended to qualify as a profit sharing plan under Section 401(k) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). | |

| | ||||

| Supplemental Retirement Plan | | | A funded, nonqualified plan that provides | |

We offer

WeCode.

|

|

1.

We

2020.

In connection with the IPO, wethe Company adopted the Executive Severance Plan and Executive Change in Control Plan. The Executive Severance Plan provides for severance payments upon certain terminations of employment to our Named Executive Officers and other senior executives who are expected to make substantial contributions to our success and thereby provides for stability and continuity of operations. The Named Executive Officers are generally provided with severance payments for a period of two years for Mr. Jurek (who will receive the sum of two times base salary plus two times previous year bonus), one year for Mr. Naemura (who will receive the sum of one times base salary plus one times previous year bonus) and two years for the other Named Executive Officers (who will receive two times base salary) should his or her employment be terminated either by us without “cause” or by the executive for “constructive termination.” The Executive Severance Plan also provides for reimbursement for reasonable outplacement and provides health and dental benefit continuation assistance.

The Executive Change in Control Plan provides double-trigger benefits to Mr. Jurek and all of our executive vice presidents (including each of the Named Executive Officers), regional presidents and select senior vice presidents. The Executive Change in Control Plan serves to encourage these key executives to carry out their duties and provide continuity of management in the event of a “change in control” of Gates. The Named

Executive Officers are generally provided with payments in the amount of two andone-half times base salary plus target bonus (for Mr. Jurek) and one andone-half times base salary plus target bonus (for the other Named Executive Officers) should his or her employment be terminated either by us without “cause” or by the executive for “constructive termination” within thetwo-year period following a change in control. The Executive Change in Control Plan also provides for reimbursement for reasonable outplacement and provides life and long-term disability insurance and health and dental benefit continuation assistance. The benefits provided under both the Executive Severance Plan and the Executive Change in Control Plan are contingent upon the affected Named Executive Officer’s execution andnon-revocation of a general release of claims and compliance with specified restrictive covenants. See “Potential Payments upon a Termination or Change in Control,” which describes the payments to which each of thePlan. Named Executive Officers may beare not entitled to payments under the Executive Severance Plan andif they are entitled to receive payment under the Executive Change in Control Plan.

Plan discussed below. For information regarding these plans, please see “Potential Payments upon Termination or Change in Control.” Prior to 2020, the Company provided limited single-trigger change in control benefits to certain Named Executive Officers in their Options and RSU award agreements. Beginning in 2020, the Options and RSU award agreements provide for double trigger vesting based upon the occurrence of both a change in control and a qualified termination. The terms of the Company’s Supplemental Retirement Plan also provide for early distribution upon a change in control.

the Company.

annual measurement date, February 1, 2020. Any Named Executive Officerofficer who does not meet the threshold will beis required to retain 50% of stock acquired through the exercise or vesting of equity awards made by the Company.

Currently, each Named Executive Officer is expected to own the Company’s ordinary shares in the amounts listed below. As of the annual measurement date, all of the then-employed Named Executive Officers either met the applicable ownership guidelines or were in compliance with the equity retention mandate.

| | Chief Executive Officer | | | 6 times base salary | |

| | Other Named Executive Officers | | | 3 times base salary | |

Report.

Terry Klebe

Neil P. Simpkins

David Calhoun

Julia C. Kahr

| | CEO total annual compensation | | | | $ | 7,680,120 | | |

| | Median employee total annual compensation | | | | $ | 35,940 | | |

| | Ratio | | | 214 to 1 | | |||

in this Proxy Statement.

| Name and Principal Position | | | Year | | | Salary ($)(1) | | | Bonus ($)(2) | | | Stock Awards ($)(3) | | | Option Awards ($)(3) | | | Non-Equity Incentive Plan Compensation ($)(4) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($)(5) | | | Total ($)(6) | | |||||||||||||||||||||||||||

| Ivo Jurek | | | | | 2020 | | | | | $ | 1,063,962 | | | | | $ | 1,545,000 | | | | | $ | 3,827,542 | | | | | $ | 1,158,749 | | | | | | — | | | | | | — | | | | | $ | 84,867 | | | | | $ | 7,680,120 | | |

| Chief Executive Officer | | | | | 2019 | | | | | $ | 989,635 | | | | | | — | | | | | $ | 3,350,070 | | | | | $ | 5,982,476 | | | | | | — | | | | | | — | | | | | $ | 164,509 | | | | | $ | 10,486,690 | | |

| | | | | | 2018 | | | | | $ | 943,269 | | | | | | — | | | | | | — | | | | | | — | | | | | $ | 1,389,150 | | | | | | — | | | | | $ | 201,983 | | | | | $ | 2,534,402 | | |

| L. Brooks Mallard | | | | | 2020 | | | | | $ | 465,385 | | | | | $ | 568,852 | | | | | $ | 745,450 | | | | | $ | 344,849 | | | | | | — | | | | | | — | | | | | $ | 102,331 | | | | | $ | 2,226,867 | | |

| Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| David Wisniewski, | | | | | 2020 | | | | | $ | 410,956 | | | | | $ | 188,973 | | | | | $ | 229,633 | | | | | $ | 105,029 | | | | | | — | | | | | | — | | | | | $ | 31,442 | | | | | $ | 966,033 | | |

| Chief Financial Officer (interim) and Chief Accounting Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| David Naemura, | | | | | 2020 | | | | | $ | 130,493 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | $ | 8,870 | | | | | $ | 139,363 | | |

| Chief Financial Officer (former) | | | | | 2019 | | | | | $ | 624,851 | | | | | | — | | | | | $ | 1,029,035 | | | | | $ | 455,371 | | | | | | — | | | | | | — | | | | | $ | 89,871 | | | | | $ | 2,199,128 | | |

| | | | 2018 | | | | | $ | 609,423 | | | | | | — | | | | | | — | | | | | | — | | | | | $ | 687,470 | | | | | | — | | | | | $ | 110,023 | | | | | $ | 1,406,916 | | | ||

| Roger Gaston, | | | | | 2020 | | | | | $ | 432,385 | | | | | $ | 399,000 | | | | | $ | 469,713 | | | | | $ | 214,829 | | | | | | — | | | | | | — | | | | | $ | 37,467 | | | | | $ | 1,553,394 | | |

| Chief Human Resources Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Grant Gawronski, | | | | | 2020 | | | | | $ | 688,997 | | | | | $ | 634,196 | | | | | $ | 1,156,005 | | | | | $ | 528,715 | | | | | | — | | | | | | — | | | | | $ | 51,461 | | | | | $ | 3,059,374 | | |

| Chief Commercial Officer | | | | | 2019 | | | | | $ | 636,519 | | | | | | — | | | | | $ | 1,152,394 | | | | | $ | 509,972 | | | | | | — | | | | | | — | | | | | $ | 74,818 | | | | | $ | 2,373,703 | | |

| | | | | | 2018 | | | | | $ | 503,846 | | | | | | — | | | | | | — | | | | | $ | 1,700,600 | | | | | $ | 455,096 | | | | | | — | | | | | $ | 36,527 | | | | | $ | 2,696,069 | | |

| Walt Lifsey, | | | | | 2020 | | | | | $ | 690,706 | | | | | $ | 669,231 | | | | | $ | 1,158,882 | | | | | $ | 530,030 | | | | | | — | | | | | | — | | | | | $ | 56,884 | | | | | $ | 3,105,733 | | |

| Chief Operating Officer | | | | | 2019 | | | | | $ | 639,703 | | | | | | — | | | | | $ | 1,155,267 | | | | | $ | 511,237 | | | | | | — | | | | | | — | | | | | $ | 83,436 | | | | | $ | 2,389,643 | | |

| | | | | | 2018 | | | | | $ | 607,640 | | | | | | — | | | | | | — | | | | | | — | | | | | $ | 567,300 | | | | | | — | | | | | $ | 96,532 | | | | | $ | 1,271,472 | | |

Name and Principal | Year | Salary ($)(1) | Bonus ($) | Stock Awards ($) | Option Awards ($)(2) | Non-Equity Incentive Plan Compensation ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)(4) | Total ($)(5) | |||||||||||||||||||||||||||

Ivo Jurek | 2018 | $ | 943,269 | — | — | — | $ | 1,389,150 | — | $ | 201,983 | $ | 2,534,402 | |||||||||||||||||||||||

Chief Executive | 2017 | $ | 900,000 | — | — | $ | 749,472 | $ | 2,025,000 | — | $ | 195,305 | $ | 3,869,777 | ||||||||||||||||||||||

Officer | 2016 | $ | 900,000 | — | — | — | $ | 1,750,000 | — | $ | 128,898 | $ | 2,778,898 | |||||||||||||||||||||||

David Naemura | 2018 | $ | 609,423 | — | — | — | $ | 687,470 | — | $ | 110,023 | $ | 1,406,916 | |||||||||||||||||||||||

Chief Financial | 2017 | $ | 572,789 | $ | 22,212 | — | — | $ | 1,026,375 | — | $ | 113,058 | $ | 1,734,434 | ||||||||||||||||||||||

Officer | 2016 | $ | 509,135 | — | — | — | $ | 823,000 | — | $ | 56,373 | $ | 1,388,508 | |||||||||||||||||||||||

Grant Gawronski, | 2018 | $ | 503,846 | — | — | $ | 1,700,600 | $ | 455,096 | — | $ | 36,527 | $ | 2,696,069 | ||||||||||||||||||||||

EVP, Chief Commercial Officer | ||||||||||||||||||||||||||||||||||||

Jamey Seely, | 2018 | $ | 425,000 | — | — | $ | 618,400 | $ | 282,625 | — | $ | 62,842 | $ | 1,388,867 | ||||||||||||||||||||||

EVP, General | 2017 | $ | 120,962 | $ | 180,000 | — | $ | 635,250 | $ | 148,601 | — | $ | 45,256 | $ | 1,130,069 | |||||||||||||||||||||

Counsel and Corporate Secretary | ||||||||||||||||||||||||||||||||||||

Walt Lifsey, | 2018 | $ | 607,640 | — | — | — | $ | 567,300 | — | $ | 96,532 | $ | 1,271,472 | |||||||||||||||||||||||

Chief Operating | 2017 | $ | 541,592 | — | — | — | $ | 822,938 | — | $ | 80,795 | $ | 1,445,325 | |||||||||||||||||||||||

Officer | 2016 | $ | 507,885 | — | — | $ | 335,220 | $ | 627,000 | — | $ | 469,575 | $ | 1,939,680 | ||||||||||||||||||||||

|

|

|

|

Name | Company Contributions to Gates MatchMaker 401(k)(a) | Company Contributions to Gates Executive Supplemental Retirement Benefit Plan(b) | Relocation(c) | Tax Gross-ups(d) | Other Benefits(e) | Total | ||||||||||||||||||

I. Jurek | $ | 16,500 | $ | 161,596 | — | — | $ | 23,886 | $ | 201,983 | ||||||||||||||

D. Naemura | $ | 16,500 | $ | 81,648 | — | — | $ | 11,875 | $ | 110,023 | ||||||||||||||

G. Gawronski | $ | 16,500 | $ | 13,731 | — | — | $ | 6,297 | $ | 36,527 | ||||||||||||||

J. Seely | $ | 16,500 | $ | 28,716 | $ | 5,428 | $ | 2,214 | $ | 9,984 | $ | 62,842 | ||||||||||||

W. Lifsey | $ | 16,500 | $ | 69,335 | — | — | $ | 10,698 | $ | 96,532 | ||||||||||||||

|

|

|

|

|

2018

| Name | | | Company Contributions to Gates MatchMaker 401(k)(a) | | | Company Contributions to Gates Executive Supplemental Retirement Benefit Plan(b) | | | Relocation(c) | | | Tax Gross-ups(d) | | | Other Benefits(e) | | | Total | | ||||||||||||||||||

| I. Jurek | | | | $ | 17,100 | | | | | $ | 46,738 | | | | | | — | | | | | | — | | | | | $ | 21,029 | | | | | $ | 84,867 | | |

| L. Mallard | | | | $ | 17,100 | | | | | $ | 10,823 | | | | | $ | 46,335 | | | | | $ | 19,701 | | | | | $ | 8,372 | | | | | $ | 102,331 | | |

| D. Wisniewski | | | | $ | 17,100 | | | | | $ | 7,557 | | | | | | — | | | | | | — | | | | | $ | 6,785 | | | | | $ | 31,442 | | |

| D. Naemura | | | | $ | 5,075 | | | | | | — | | | | | | — | | | | | | — | | | | | $ | 3,795 | | | | | $ | 8,870 | | |

| R. Gaston | | | | $ | 17,100 | | | | | $ | 8,843 | | | | | | — | | | | | | — | | | | | $ | 11,524 | | | | | $ | 37,467 | | |

| G. Gawronski | | | | $ | 17,100 | | | | | $ | 24,240 | | | | | | — | | | | | | — | | | | | $ | 10,121 | | | | | $ | 51,461 | | |

| W. Lifsey | | | | $ | 17,100 | | | | | $ | 24,342 | | | | | | — | | | | | | — | | | | | $ | 15,442 | | | | | $ | 56,884 | | |

| | | | | | | Grant Date | | | Estimated Future Payouts under non-equity incentive plan awards ($) | | | Estimated Future Payouts under Equity incentive plan awards (#) | | | All other stock awards: number of shares of stock units (#) | | | All other option awards: number of securities underlying options (#) | | | Exercise or base price of option awards ($/sh) | | | Grant date fair value of stock and option awards ($) | | |||||||||||||||||||||||||||||||||||||||||||||

| Name | | | Award Type | | | Threshold | | | Target | | | Max | | | Threshold | | | Target | | | Max | | ||||||||||||||||||||||||||||||||||||||||||||||||

| I. Jurek | | | Annual Plan(1) | | | | | — | | | | | $ | 154,500 | | | | | $ | 1,545,000 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | 1,839 | | | | | | 183,928 | | | | | | 367,856 | | | | | | | | | | | | | | | | | | | | | | | $ | 2,668,795 | | |

| | | | RSU(3) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 91,964 | | | | | | | | | | | | | | | | | $ | 1,158,746 | | |

| | | | Options(4) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 241,406 | | | | | $ | 12.60 | | | | | $ | 1,158,749 | | |

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| L. Mallard | | | Annual Plan(1) | | | | | — | | | | | $ | 46,888 | | | | | $ | 468,875 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2) | | | | | 2/24/2020 | | | | | | | | | | | | | | | | | | | | | | | | 302 | | | | | | 30,212 | | | | | | 60,424 | | | | | | | | | | | | | | | | | | | | | | | $ | 400,611 | | |

| | | | RSU(3) | | | | | 2/24/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 29,323 | | | | | | | | | | | | | | | | | $ | 344,838 | | |

| | | | Options(4) | | | | | 2/24/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 76,294 | | | | | $ | 11.76 | | | | | $ | 344,849 | | |

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| D. Wisniewski | | | Annual Plan(1) | | | | | — | | | | | $ | 19,892 | | | | | $ | 198,919 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | 85 | | | | | | 8,588 | | | | | | 17,176 | | | | | | | | | | | | | | | | | | | | | | | $ | 124,612 | | |

| | | | RSU(3) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,335 | | | | | | | | | | | | | | | | | $ | 105,021 | | |

| | | | Options(4) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 21,881 | | | | | $ | 12.60 | | | | | $ | 105,029 | | |

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R. Gaston | | | Annual Plan(1) | | | | | — | | | | | $ | 42,000 | | | | | $ | 420,000 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2 | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | 175 | | | | | | 17,566 | | | | | | 35,132 | | | | | | | | | | | | | | | | | | | | | | | $ | 254,883 | | |

| | | | RSU(3) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 17,050 | | | | | | | | | | | | | | | | | $ | 214,830 | | |

| | | | Options(4) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 44,756 | | | | | $ | 12.60 | | | | | $ | 214,829 | | |

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| G. Gawronski | | | Annual Plan(1) | | | | | — | | | | | $ | 66,758 | | | | | $ | 667,575 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | 432 | | | | | | 43,232 | | | | | | 86,464 | | | | | | | | | | | | | | | | | | | | | | | $ | 627,296 | | |

| | | | RSU(3) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 41,961 | | | | | | | | | | | | | | | | | $ | 528,709 | | |

| | | | Options(4) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 110,149 | | | | | $ | 12.60 | | | | | $ | 528,715 | | |

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| W. Lifsey | | | Annual Plan(1) | | | | | — | | | | | $ | 66,923 | | | | | $ | 669,231 | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | PRSU(2) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | 433 | | | | | | 43,340 | | | | | | 86,680 | | | | | | | | | | | | | | | | | | | | | | | $ | 628,863 | | |

| | | | RSU(3) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 42,065 | | | | | | | | | | | | | | | | | $ | 530,019 | | |

| | | | Options(4) | | | | | 2/21/2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 110,423 | | | | | $ | 12.60 | | | | | $ | 530,030 | | |

| Estimated Future Payouts under non-equity incentive plan awards ($) | All other option awards: number of securities underlying options (#) | Exercise or base price of option awards ($/sh) | Grant date fair value of stock and option awards ($) | |||||||||||||||||||||||||

Name | Grant Date | Threshold | Target | Maximum | ||||||||||||||||||||||||

I. Jurek(1) | $ | 141,750 | $ | 1,417,500 | — | |||||||||||||||||||||||

D. Naemura(1) | $ | 70,150 | $ | 701,500 | — | |||||||||||||||||||||||

G. Gawronski(1) | $ | 45,510 | $ | 455,096 | — | |||||||||||||||||||||||

2018 Options(2) | 3/9/2018 | 220,000 | $ | 17.72 | $ | 1,700,600 | ||||||||||||||||||||||

J. Seely(1) | $ | 29,750 | $ | 297,500 | — | |||||||||||||||||||||||

2018 Options(2) | 3/9/2018 | 80,000 | $ | 17.72 | $ | 618,400 | ||||||||||||||||||||||

W. Lifsey(1) | $ | 61,000 | $ | 610,000 | — | |||||||||||||||||||||||

|

|

Narrative Disclosure Relating to the Summary Compensation TableAnnual Plan by each Named Executive Officer for 2020 was $0.

Employment Agreements

Previously, Messrs. Jurek, Naemura and Lifsey entered into employment agreements with us in connection with their commencement of employment. In connection with the adoptionmaximum payout shares of the Executive Severance Plan and the Executive Change in Control Plan, each of Messrs. Jurek, Naemura and Lifsey agreed to terminate their existing employment agreements with us.

Equity-Based Awards

2018 Grants

Mr. Gawronski and Ms. Seely were awarded stock optionsPRSUs granted under the 2018 Omnibus Incentive Plan in 2020. Threshold payout of shares is calculated assuming an attainment of 0.1% above threshold for the Adjusted ROIC measure. The number of shares ultimately issued, which could be greater or less than target, will be based on March 9, 2018achieving specific performance conditions. Please refer to better align Mr. Gawronski’s compensation to the market and to reward Ms. Seely’s performance and contributions toward the completion“Elements of Compensation — Long-Term Incentive” above. The grant date fair value of the IPOPRSUs for the February 21, 2020 award (February 24, 2020 award for Mr. Mallard) was calculated in accordance with ASC Topic 718 based on target, the amount of 220,000 and 80,000 stock options respectively. No other long-term equity incentive awards were granted to the Named Executive Officers in fiscal 2018.

The stock options granted to Mr. Gawronski and Ms. Seely in 2018 are time-based and vest ratably on eachprobable outcome of the first four anniversaries of the grant date, subject to the executive’s continued employment.

In connection with a termination for “cause” (as definedperformance conditions.

IfRSUs for the February 21, 2020 award (February 24, 2020 award for Mr. Gawronski or Ms. Seely engagesMallard) was the closing price on the date of the grant.

See “Potential Payments upon a Termination or Change in Control—Long-Term Incentive Awards” below for a description of the potential vesting under the Named Executive Officers equity awards in connection with a Change in Control or certain terminations of employment.

Pre-IPO Option Grants

Prior to the IPO, our Named Executive Officers, other than Mr. Gawronski, received grants of stock options under the 2014 Incentive Plan. As discussed under “Long-Term Incentive—2014 Incentive Plan,” in connection with the IPO and the assumption by Gates of the awards under the 2014 Omaha Topco Ltd. Stock Incentive Plan, Omaha Topco options were converted into Gates options and the exercise prices were adjusted to ensure that the options received were of equivalent economic value to the legacy Omaha Topco options.

The stock options are divided into four equally weighted tranches referred to as “Tiers” for vesting purposes. Tier I of the stock options (25% of the total award) is subject to time-based vesting restrictions that vest 20% on each of the first five anniversaries of the grant date or vesting reference date, as applicable. Tiers II, III and IV (each 25% of the total) are subject to exit-based vesting and will vest and become exercisable if either the specified internal rate of return or multiple of investment targets noted below are achieved:

|

|

|

|

|

Any part of a Named Executive Officer’s stock option award that is vested upon termination of employment by us without “Cause” or by the Named Executive Officer for “good reason” (as such terms are defined in the stock option agreements), will generally remain outstanding and exercisable for 90 days following the termination of employment. This period is shortened to 30 days if the Named Executive Officer resigns without good reason and no grounds for a termination by us for Cause exists, and is extended to 12 months if employment is terminated due to death or Disability. Vested options will immediately terminate if the Named Executive Officer’s employment is terminated by us for Cause, if the Named Executive Officer resigns without good reason when grounds for Cause exist or if there is a restrictive covenant violation. Any vested options that are not exercised within the applicable post-termination exercise window will terminate. Any part of a Named Executive Officer’s stock option award that vests following a termination without Cause, for good reason or due to death or Disability, will generally remain outstanding and exercisable for 60 days following the date such option vested. In each case, the exercise period will be shortened to the expiration date of the stock option, if earlier. See “Potential Payments upon a Termination or Change in Control—Long-Term Incentive Awards” below for a description of the potential vesting that each of these Named Executive Officers may be entitled to in connection with a Change in Control or certain terminations of employment.

By accepting a grant of options pursuant to the 2014 Incentive Plan and the stock option award agreement, our Named Executive Officers agreed to certain restrictive covenants, including an indefinite covenant not to disclose confidential information and not to disparage us, and, during each of the executive’s employment and for theone-year period following any termination of employment (or such longer period as the Named Executive Officer is eligible to receive severance payments from us), covenants related tonon-competition andnon-solicitation of employees, customers or suppliers.

In addition, as a condition to receiving his or her equity-based awards and in connection with investments in our common stock, each Named Executive Officer was required to enter into a subscription agreement , which, along with the award agreement, generally govern the Named Executive Officers’ rights with respect to any shares of our common stock purchased or acquired on exercise of vested stock options.

If a Named Executive Officer materially breaches any of these restrictive covenants contained in the stock option award agreement, then we have the right to “claw back” and recover any gains the Named Executive Officer may have realized with respect to his or her shares acquired under the terms of the stock option agreement or pursuant to the subscription agreement, as applicable. If the Named Executive Officer (i) is terminated for “Cause” (as defined in the respective Named Executive Officer’s employment agreements), (ii) voluntarily resigns when grounds exist for “Cause” or (iii) violates a restrictive covenant, then we have the right to repurchase his or her shares, including any shares issuable or issued upon the exercise of any options for the lesser of (a) fair market value (measured as of the purchase date) and (b) cost.

Pre-IPO RSU Grants

Prior to the IPO,February 21, 2020 award (February 24, 2020 award for Mr. Gawronski receivedMallard) was calculated in accordance with ASC Topic 718 using a grant of RSUs under the 2014 Incentive Plan which were converted into Gates RSUs in connection with the IPO.

Black-Scholes valuation model.

By accepting a grant of RSUs pursuant to the 2014 Incentive Plan and the RSU award agreement, Mr. Gawronski agreed to certain restrictive covenants, discussed above under

See “Potential Payments upon a Termination or Change in Control—Long-Term Incentive Awards” below for a description of the potential vesting under Mr. Gawronski’s equity awards in connection with a Change in Control.

Outstanding Equity Awards at December 29, 2018

January 2, 2021

| | | | | | | Option Awards | | | Stock Awards | | | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Name | | | Grant Date | | | Number of securities underlying unexercised options (#) exercisable | | | Number of securities underlying unexercised options (#) unexercisable | | | Equity Incentive Plan Awards: Number of securities underlying unexercised unearned options (#)(2) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of shares or units of stock that have not vested (#)(3) | | | Market value of shares or units of stock that have not vested ($)(4) | | | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#)(5) | | | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(6) | | | |||||||||||||||||||||||||||||

| I. Jurek | | | 5/18/2015 Tier I(1) | | | | | 1,017,239 | | | | | | — | | | | | | | | | | | $ | 6.56 | | | | | | 5/18/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/18/2015 Tier II | | | | | | | | | | | | | | | | | 1,017,239 | | | | | $ | 6.56 | | | | | | 5/18/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/18/2015 Tier III | | | | | | | | | | | | | | | | | 1,017,239 | | | | | $ | 6.56 | | | | | | 5/18/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/18/2015 Tier IV | | | | | | | | | | | | | | | | | 1,017,239 | | | | | $ | 9.84 | | | | | | 5/18/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/2/2017 Tier I(1) | | | | | 81,297 | | | | | | 54,199 | | | | | | | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/2/2017 Tier II | | | | | | | | | | | | | | | | | 135,496 | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/2/2017 Tier III | | | | | | | | | | | | | | | | | 135,496 | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 5/2/2017 Tier IV | | | | | | | | | | | | | | | | | 135,496 | | | | | $ | 11.80 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 Options(7) | | | | | 84,040 | | | | | | 168,082 | | | | | | | | | | | $ | 16.46 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 Options(8) | | | | | — | | | | | | 796,460 | | | | | | | | | | | $ | 19.00 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 60,146 | | | | | $ | 767,463 | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 24,167 | | | | | $ | 308,371 | | | | ||

| | | | 2/21/2020 Options(9) | | | | | — | | | | | | 241,406 | | | | | | | | | | | $ | 12.60 | | | | | | 2/21/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/21/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 91,964 | | | | | $ | 1,173,461 | | | | | | | | | | | | | | | | ||

| | | | 2/21/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 47,821 | | | | | $ | 610,196 | | | | ||

| | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| L. Mallard | | | 2/24/2020 Options(9) | | | | | — | | | | | | 76,294 | | | | | | | | | | | $ | 11.76 | | | | | | 2/24/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/24/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 29,323 | | | | | $ | 374,161 | | | | | | | | | | | | | | | | ||

| | | | 2/24/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 7,855 | | | | | $ | 100,230 | | | | ||

| | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| D. Wisniewski | | | 4/9/2018 Options(10) | | | | | 9,750 | | | | | | 9,750 | | | | | | | | | | | $ | 16.54 | | | | | | 4/9/2028 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 4/9/2018 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,779 | | | | | $ | 48,220 | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 Options(7) | | | | | 5,409 | | | | | | 10,821 | | | | | | | | | | | $ | 16.46 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,872 | | | | | $ | 49,407 | | | | | | | | | | | | | | | | ||

| | | | 2/22/2019 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,555 | | | | | $ | 19,835 | | | | ||

| | | | 2/21/2020 Options(9) | | | | | — | | | | | | 21,881 | | | | | | | | | | | $ | 12.60 | | | | | | 2/21/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 2/21/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,335 | | | | | $ | 106,355 | | | | | | | | | | | | | | | | ||

| | | | 2/21/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,232 | | | | | $ | 28,480 | | | | ||

| | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R. Gaston | | | 8/8/2016 Tier I(1) | | | | | 54,198 | | | | | | 13,550 | | | | | | | | | | | $ | 6.56 | | | | | | 8/8/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 8/8/2016 Tier II | | | | | | | | | | | | | | | | | 67,748 | | | | | $ | 6.56 | | | | | | 8/8/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 8/8/2016 Tier III | | | | | | | | | | | | | | | | | 67,748 | | | | | $ | 6.56 | | | | | | 8/8/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | 8/8/2016 Tier IV | | | | | | | | | | | | | | | | | 67,748 | | | | | $ | 9.84 | | | | | | 8/8/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | | | | | | Option Awards | | | Stock Awards | | ||||||||||||||||||||||||||||||||||||||||||||||||

| Name | | | Grant Date | | | Number of securities underlying unexercised options (#) exercisable | | | Number of securities underlying unexercised options (#) unexercisable | | | Equity Incentive Plan Awards: Number of securities underlying unexercised unearned options (#)(2) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of shares or units of stock that have not vested (#)(3) | | | Market value of shares or units of stock that have not vested ($)(4) | | | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#)(5) | | | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(6) | | |||||||||||||||||||||||||||

| | | | 5/2/2017 Tier I(1) | | | | | 31,596 | | | | | | 21,065 | | | | | | | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/2/2017 Tier II | | | | | | | | | | | | | | | | | 52,661 | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/2/2017 Tier III | | | | | | | | | | | | | | | | | 52,661 | | | | | $ | 7.87 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/2/2017 Tier IV | | | | | | | | | | | | | | | | | 52,661 | | | | | $ | 11.80 | | | | | | 5/2/2027 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 Options(7) | | | | | 11,578 | | | | | | 23,158 | | | | | | | | | | | $ | 16.46 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,287 | | | | | $ | 105,742 | | | | | | | | | | | | | | |

| | | | 2/22/2019 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,329 | | | | | $ | 42,484 | | |

| | | | 2/21/2020 Options(9) | | | | | — | | | | | | 44,756 | | | | | | | | | | | $ | 12.60 | | | | | | 2/21/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/21/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 17,050 | | | | | $ | 217,558 | | | | | | | | | | | | | | |

| | | | 2/21/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 4,567 | | | | | $ | 58,269 | | |

| G. Gawronski | | | 3/9/2018 Options(10) | | | | | 110,000 | | | | | | 110,000 | | | | | | | | | | | $ | 17.72 | | | | | | 3/9/2028 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 Options(7) | | | | | 28,909 | | | | | | 57,821 | | | | | | | | | | | $ | 16.46 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 20,691 | | | | | $ | 264,017 | | | | | | | | | | | | | | |

| | | | 2/22/2019 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,313 | | | | | $ | 106,068 | | |

| | | | 2/21/2020 Options(9) | | | | | — | | | | | | 110,149 | | | | | | | | | | | $ | 12.60 | | | | | | 2/21/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/21/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 41,961 | | | | | $ | 535,422 | | | | | | | | | | | | | | |

| | | | 2/21/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 11,240 | | | | | $ | 143,422 | | |

| W. Lifsey | | | 8/24/2015 Tier I(1) | | | | | 250,668 | | | | | | — | | | | | | | | | | | $ | 6.56 | | | | | | 8/24/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 8/24/2015 Tier II | | | | | | | | | | | | | | | | | 250,668 | | | | | $ | 6.56 | | | | | | 8/24/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 8/24/2015 Tier III | | | | | | | | | | | | | | | | | 250,668 | | | | | $ | 6.56 | | | | | | 8/24/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 8/24/2015 Tier IV | | | | | | | | | | | | | | | | | 250,668 | | | | | $ | 9.84 | | | | | | 8/24/2025 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/12/2016 Tier I(1) | | | | | 67,748 | | | | | | 16,937 | | | | | | | | | | | $ | 6.56 | | | | | | 5/12/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/12/2016 Tier II | | | | | | | | | | | | | | | | | 84,685 | | | | | $ | 6.56 | | | | | | 5/12/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/12/2016 Tier III | | | | | | | | | | | | | | | | | 84,685 | | | | | $ | 6.56 | | | | | | 5/12/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 5/12/2016 Tier IV | | | | | | | | | | | | | | | | | 84,685 | | | | | $ | 9.84 | | | | | | 5/12/2026 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 Options(7) | | | | | 28,981 | | | | | | 57,964 | | | | | | | | | | | $ | 16.46 | | | | | | 2/22/2029 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/22/2019 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 20,742 | | | | | $ | 264,668 | | | | | | | | | | | | | | |

| | | | 2/22/2019 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,334 | | | | | $ | 106,335 | | |

| | | | 2/21/2020 Options(9) | | | | | — | | | | | | 110,423 | | | | | | | | | | | $ | 12.60 | | | | | | 2/21/2030 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2/21/2020 RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 42,065 | | | | | $ | 536,749 | | | | | | | | | | | | | | |

| | | | 2/21/2020 PRSU | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 11,268 | | | | | $ | 143,780 | | |

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||||||

Name | Grant Date | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Equity Incentive Plan Awards: Number of securities underlying unexercised unearned options (#)(2) | Option Exercise Price ($) | Option Expiration Date | Number of shares or units of stock that have not vested (#)(3) | Market value of shares or units of stock that have not vested ($)(4) | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) | ||||||||||||||||||||||||||||||||||

I. Jurek | 5/18/2015 | Tier I | (1) | 610,343 | 406,896 | — | $ | 6.56 | 5/18/2025 | |||||||||||||||||||||||||||||||||||

| 5/18/2015 | Tier II | — | — | 1,017,239 | $ | 6.56 | 5/18/2025 | |||||||||||||||||||||||||||||||||||||

| 5/18/2015 | Tier III | — | — | 1,017,239 | $ | 6.56 | 5/18/2025 | |||||||||||||||||||||||||||||||||||||

| 5/18/2015 | Tier IV | — | — | 1,017,239 | $ | 9.84 | 5/18/2025 | |||||||||||||||||||||||||||||||||||||

| 5/2/2017 | Tier I | (1) | 27,099 | 108,397 | — | $ | 7.87 | 5/2/2027 | ||||||||||||||||||||||||||||||||||||

| 5/2/2017 | Tier II | — | — | 135,496 | $ | 7.87 | 5/2/2027 | |||||||||||||||||||||||||||||||||||||

| 5/2/2017 | Tier III | — | — | 135,496 | $ | 7.87 | 5/2/2027 | |||||||||||||||||||||||||||||||||||||

| 5/2/2017 | Tier IV | — | — | 135,496 | $ | 11.80 | 5/2/2027 | |||||||||||||||||||||||||||||||||||||

D. Naemura | 3/30/2015 | Tier I | (1) | 223,157 | 148,771 | — | $ | 6.56 | 3/30/2025 | |||||||||||||||||||||||||||||||||||

| 3/30/2015 | Tier II | — | — | 371,928 | $ | 6.56 | 3/30/2025 | |||||||||||||||||||||||||||||||||||||

| 3/30/2015 | Tier III | — | — | 371,928 | $ | 6.56 | 3/30/2025 | |||||||||||||||||||||||||||||||||||||

| 3/30/2015 | Tier IV | — | — | 371,928 | $ | 9.84 | 3/30/2025 | |||||||||||||||||||||||||||||||||||||

G. Gawronski | 12/4/2017 | RSU | 50,863 | $ | 670,374 | |||||||||||||||||||||||||||||||||||||||

| 3/9/2018 | Options | (5) | — | 220,000 | — | $ | 17.72 | 3/9/2028 | ||||||||||||||||||||||||||||||||||||

J. Seely | 9/19/2017 | Tier I | (1) | 20,980 | 83,922 | — | $ | 13.44 | 9/19/2027 | |||||||||||||||||||||||||||||||||||

| 9/19/2017 | Tier II | — | — | 104,902 | $ | 13.44 | 9/19/2027 | |||||||||||||||||||||||||||||||||||||

| 9/19/2017 | Tier III | — | — | 104,902 | $ | 13.44 | 9/19/2027 | |||||||||||||||||||||||||||||||||||||

| 9/19/2017 | Tier IV | — | — | 104,902 | $ | 20.16 | 9/19/2027 | |||||||||||||||||||||||||||||||||||||

| 3/9/2018 | Options | (5) | — | 80,000 | — | $ | 17.72 | 3/9/2028 | ||||||||||||||||||||||||||||||||||||

W. Lifsey | 8/24/2015 | Tier I | (1) | 150,400 | 100,268 | — | $ | 6.56 | 8/24/2025 | |||||||||||||||||||||||||||||||||||

| 8/24/2015 | Tier II | — | — | 250,668 | $ | 6.56 | 8/24/2025 | |||||||||||||||||||||||||||||||||||||

| 8/24/2015 | Tier III | — | — | 250,668 | $ | 6.56 | 8/24/2025 | |||||||||||||||||||||||||||||||||||||

| 8/24/2015 | Tier IV | — | — | 250,668 | $ | 9.84 | 8/24/2025 | |||||||||||||||||||||||||||||||||||||

| 5/12/2016 | Tier I | (1) | 33,874 | 50,811 | — | $ | 6.56 | 5/12/2026 | ||||||||||||||||||||||||||||||||||||

| 5/12/2016 | Tier II | — | — | 84,685 | $ | 6.56 | 5/12/2026 | |||||||||||||||||||||||||||||||||||||

| 5/12/2016 | Tier III | — | — | 84,685 | $ | 6.56 | 5/12/2026 | |||||||||||||||||||||||||||||||||||||

| 5/12/2016 | Tier IV | — | — | 84,685 | $ | 9.84 | 5/12/2026 | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

2018

Name | Option Awards | Stock Awards | ||||||||||||||

| # of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | # of Shares or Units Acquired on Vesting (#) | Value Realized on Vesting ($)(1) | |||||||||||||

Ivo Jurek | — | — | — | — | ||||||||||||

David Naemura | — | — | — | — | ||||||||||||

Grant Gawronski | — | — | 25,430 | $ | 375,601 | |||||||||||

Jamey Seely | — | — | — | — | ||||||||||||

Walt Lifsey | — | — | — | — | ||||||||||||

|